The landlord must be a taxpayer with rental income under subsection 4a and subsection 4d Income Tax Act 1967. The order provide deduction as below.

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

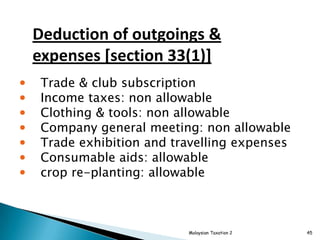

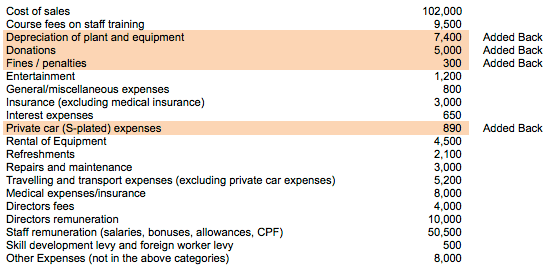

Not wholly and exclusively incurred for the purpose of business eg.

. Tax is governed strictly by tax laws which in Malaysia is principally the Income Tax Act 1967 ITA. Expenses that are not a contingent liability. Non-approved donations Employees leave passages Interest royalty contract payment technical fee rental of movable property payment to a non-resident public.

Domestic or private expenses3. MALAYSIA Date of Issue. Vehicle bring into Cos using trust deed.

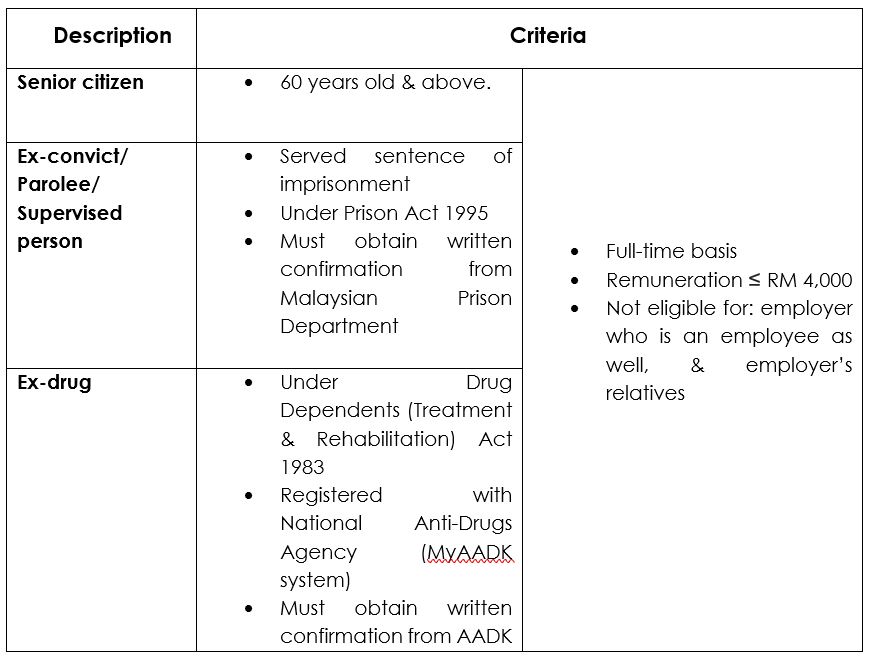

The key issue that one should pay attention when claiming a tax deduction is whether the expenditure is wholly and exclusively incurred in the production. Hiring disabled worker - Employers are eligible for tax deduction under Public Ruling No. Besides the above the Income Tax Act 1967 also specially listed down in Sec 39- deduction not allowed such as.

310 Qualifying deduction means- a an amount equal to the amount of the expenditure incurred by a person computed in any deduction falling to be made under the Act where the amount of deduction is twice the amount of the expenditure incurred by a person. Payments in respect of pensions or provident savings or. Getting A Tax DeductionTax Incentive For Your Company.

The list includes among other items. Domestic or private expenses. DEDUCTION OF EXPENSES SPECIAL DEDUCTION OF EXPENSES.

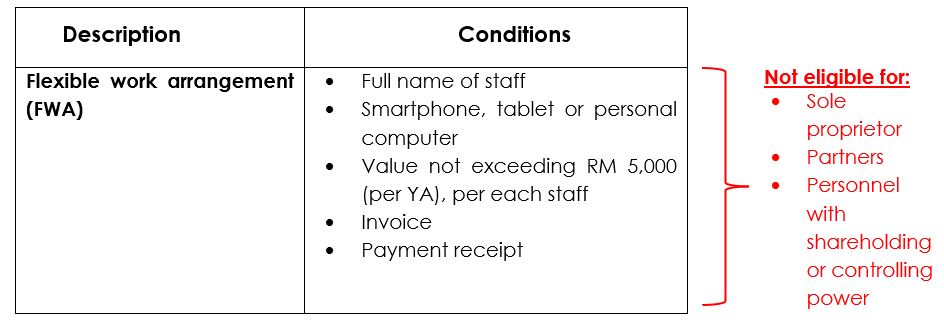

Where incentives are given by way of allowances any unutilised allowances may be carried forward indefinitely to. As we used to say staff are assets and therefore the expenses are tax deductible. This means that expenses must satisfy all of the following conditions to be considered as tax deductible.

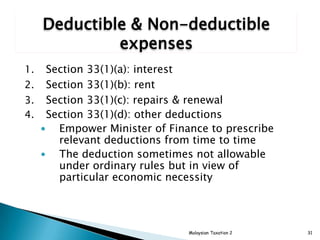

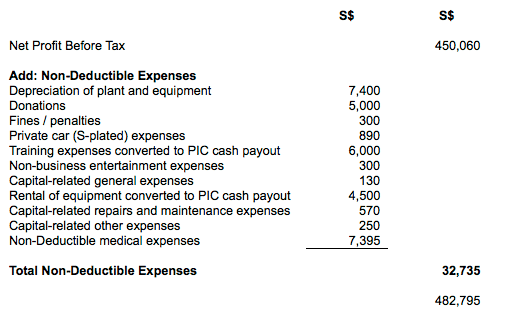

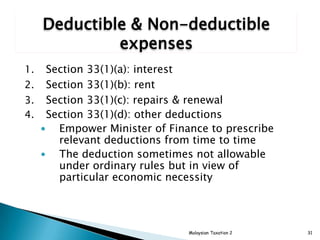

14 Income remitted from outside Malaysia. Section 33 must be read with Section 39 ITA which provides a list of outgoings and expenses that are specifically non-deductible 2. Non-resident individuals Types of income Rate Public Entertainers professional income 15.

Generally an expenditure is not tax deductible if. Other corporate tax rates include the following. 17 on the first RM 600000.

Domestic or private expenses 3. 1Entertainment to staff. Expenses on free meals refreshment annual dinners outings corporate family day or club membership for staff.

For small and medium enterprise SME the first RM600000 Chargeable Income will be tax at 17 and the Chargeable Income above RM600000 will be tax at 24. Any capital withdrawn or sum employed or intended to be employed as capital 4. Eligible for all taxpayers corporate individual cooperative or other business and non-business entities The rented premises must be used by the tenant for the purpose of carrying out business.

Legal and professional expenses are deductible for income tax purposes when incurred under certain conditions. All related expenses not deductible unless the whole amount declared as BIK. On 28 June 2019 Malaysia issued rules the Rules on the interest deductibility limitation.

6 July 2006 _____ _____ Issue. Borrowings from a non-resident may require exchange control approval. But not all costs are deductible.

Private expense Pre-commencement expenditure. 62 Renewal of loan a Legal expenses incurred by a trading or commercial company. How To Declare Rental Income In.

Corporate - Tax credits and incentives. To replace the previous deduction given on Training Cost for Skim Latihan 1 Malaysia. Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except.

Purchase of breastfeeding equipment for own use for a child aged 2 years and below Deduction allowed once in every 2 years of assessment 1000 Restricted 13. The SME company means company incorporated in Malaysia with a paid up capital of ordinary share of not more than RM25 million. 32019 of Inland Revenue Board of Malaysia.

24 in excess of RM 600000. Payment for child care fees to a registered child care centre kindergarten for a child aged 6 years and below. B any claim for deduction under any rules made under paragraph 1541b of.

Deduction if the expense was incurred on any money borrowed and employed in the production of gross income or laid out on assets used or held for the production of gross income. These rules and guidelines follow the proposal of the limitation in the 2019 budget 2 released on 2 November 2018 and enacted. Section 33 must be read with Section 39 ITA which provides a list of outgoings and expenses that are specifically non-deductible 2.

Expenses that are incurred solely in the production of income. For example if you are going to entertain a potential client at dinner for future business purposes you can usually deduct that expense. Malaysia adopts a territorial system of income taxation.

A company or corporate whether resident or not is. It can be difficult to understand the differences between deductible and non-deductible expenses. 2Entertainment expenses in having ordinary course of business.

The standard corporate income tax rate in Malaysia is 24. In short when you spend money to earn money youre allowed to deduct that cost from the income. The legislation dealing with the general deduction is stated in Section 33 1 of the ITA.

Malaysia has introduced ESR in effect 1 July 2019. Tax incentives can be granted through income exemption or by way of allowances. All related expenses non-deductible.

Malaysia has a wide variety of incentives covering the major industry sectors. Where a borrowing is partly used to finance non-business operations the proportion of interest expense will be allowed against the. Or deduction granted for that YA under the Income Tax Act 1967 or any other written.

Last reviewed - 14 December 2021. Incidental costs of raising loan finance such as legal rating and guarantee fees are viewed as capital costs and so are non-deductible except for certain Islamic financing and asset- backed securitizations. For example if you take up a job while overseas and you only receive the payment for the job when you are back in.

In this article the author urges the tax authority to review the deductions available in Public Ruling 62006. Resident companies are taxed at the rate of 24. A business can only claim a tax deduction if the expenses are wholly and exclusively incurred in the production of income.

Legal and other expenses incurred by a person in collecting nontrade debts and loans of a capital nature. Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia and received in Malaysia by a resident individual is exempted from tax. Yes there is a tax deduction for employers in Malaysia subjected to the terms and conditions set by the LHDN.

Resident company with a paid-up capital of RM 25 million or less and gross income from business of not more than RM 50 million. Malaysia Corporate - Deductions. The list includes among other items.

The list goes as follows. For example like organizing a cultural event Malay dance. 1 On 5 July 2019 the Malaysian Inland Revenue Board the IRB released guidelines the Guidelines to supplement the Rules.

But if you go to a movie with a coworker that would be a non-deductible expense. A Translation from the original Bahasa Malaysiatext Page 4 of 5 61 Debt collection Legal and other expenses incurred by a person in the collection of non-trade debts and loans of a capital nature.

List Of Tax Deduction For Businesses Cheng Co Group

Chapter 5 Corporate Tax Stds 2

Tax Treatment On Entertainment Expenses Asq

List Of Tax Deduction For Businesses Cheng Co Group

Updated Guide On Donations And Gifts Tax Deductions

7 Steps To Calculating Estimated Chargeable Income Eci Tinkertax

List Of Non Allowable Expenses In Malaysia 2018 Lucarkc

Types Of Taxes In Malaysia For Companies

List Of Non Allowable Expenses Gabrieltrf

Tax Deductible Expenses The Malaysian Institute Of Certified

7 Steps To Calculating Estimated Chargeable Income Eci Tinkertax

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Chapter 5 Corporate Tax Stds 2

List Of Tax Deduction For Businesses Cheng Co Group

List Of Tax Deduction For Businesses Cheng Co Group

List Of Tax Deduction For Businesses Cheng Co Group

List Of Tax Deduction For Businesses Cheng Co Group

List Of Tax Deduction For Businesses Cheng Co Group